And depending on the type of stock options you have, how many you have, other types of employee stock options you own — along with all your other specific financial planning needs — understanding what to do with your employee stock options can become even more difficult to figure out.

That’s the bad news. The good news is that with a little reading and some education on the must-know stuff, you can get yourself up to speed with the basics of employee stock options quickly.

That includes getting an introduction into what a stock option actually is, when you can do something with your options, what happens when you exercise an option, and how much your options are worth.

If you have a clearer understanding of these basics, you can begin to dive deeper into the world of stock option taxation, exercise strategies, and the ever-present beast that is income tax.

But for now, let’s stick to those basics and look at what you need to know to help successfully manage this kind of compensation.

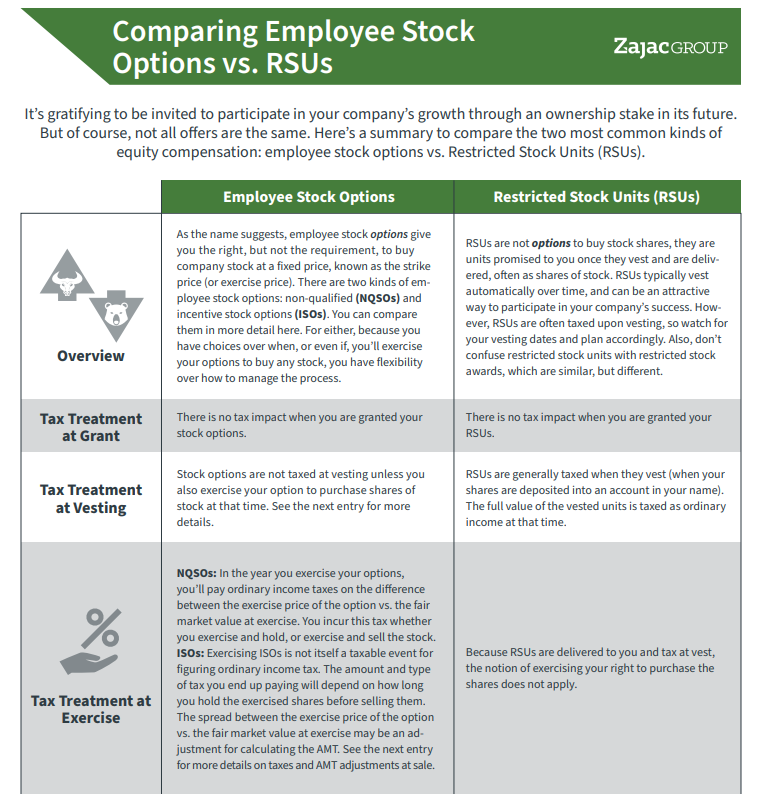

COMPARISON GUIDE

Not All Stock Offers are the Same! Here's a helpful comparison between two of the most common employee stock options.

Understand the Basics of How Employee Stock Options Work

An employee stock option is a right to purchase company stock at a predetermined price sometime in the future. It’s a right to purchase the stock, not an obligation to do so.

If the stock price appreciates above the price at which you can buy the stock, you win. If the stock price goes below the price at which you can buy the stock, you don’t necessarily lose because you’re not required to do anything.

Let’s assume that you work for company XYZ. And as part of your employment package, they offer you the following stock options):

- Employee Stock Option:1,000 shares

- Grant Price: $10

In this example, XYZ company gives you the right to buy up to 1,000 shares at $10 per share, regardless of the prevailing market price of those shares. This right has the potential to be very valuable.

We can illustrate the potential value of these stock options using a simple illustration that looks at employee stock options in both good and bad markets. For a good market, we will assume a market value is $50 per share and for a bad market value we will assume $5 per share:

| Shares | Grant Price | Future Share Price | Value | |

| Current Market Value | 1,000 | $10.00 | $10.00 | $0.00 |

| Good Market Value | 1,000 | $10.00 | $50.00 | $40,000 |

| Bad Market | 1,000 | $10.00 | $5.00 | ($5,000) |

If the future stock price equals the grant price or is lower than the grant price (a bad market), your stock options have no current value. The value in the stock option lies in the opportunity to profit if the stock price goes up in the future. If the stock price is greater than the grant price (a good market), your stock option has a current value.

In our example, you can buy shares of stock for $10 per share via the option. If the stock is currently priced at $50 per share, you can immediately turn around and sell that same exact stock for a $40 profit per share.

You also have the right to do this 1,000 times (1 time for each share). If you exercise and sell all your shares, the total value is $40,000 (which is the difference between the price you can buy the stock and the price you can immediately turn around and sell).

If the future market price is below the grant price, you would choose to do nothing. Why buy a stock at $10 per share via your option when you can buy it elsewhere for $5 per share?

This short example is a simple and watered-down version of how employee stock options work and how you may make money if you are lucky enough to own them. But it gets more complicated from here.

The Employee Stock Option Terms You Need to Know

When your employer issues your employee stock options, you should receive a document that details the specifics and rules around your options.

A few key items to focus on include:

- Grant price (or strike price), which is the price at which you can purchase your company stock.

- Number of shares, which represents the number of shares you can You can opt to buy less than this amount if you’d like, but you cannot buy more.

- The vesting schedule, which lets you know when you can exercise your right to buy the stock. When your employer offers stock options, you must wait a certain amount of time before you can exercise your right to buy the shares. Often this period of time is a set number of years (known as a cliff schedule), or a certain percentage of the stock options over a certain number of years (known as a graded schedule).

- The expiration date, which is typically set 10 years from the date the stock option was granted. The expiration date is the date at which you can no longer exercise your right to the option. Once this date passes, any unexercised shares go away.

A quick note on one of these terms: A vesting schedule is used by an employer to help keep you working for the company. They provide you a future right to something that may be valuable to incentivize you to stay to at least that point in the future.

If the stock option does have value, that value may keep you working at your company until you can take advantage of your stock option right. In addition, the opportunity to generate wealth via a stock price that goes up may keep you motivated along the way.

These four terms will provide you enough ammunition to know what you own, when you can use it, and when it goes away.

Beyond these key points, the documentation around your options should also spell out regarding what happens to your stock option if you terminate employment via death, disability, and retirement. Other details will cover what happens if you leave your company or if your company merges with another.

The Two Types of Employee Stock Options

Employee stock options are given in two forms:

Generally speaking, they both have identical features as discussed above. However, incentive stock options and non-qualified stock options are materially different.

Incentive stock options (ISOs) are employee stock options that may allow for a potential tax advantage. Because of this advantage, they are often seen as superior to their non-qualified stock option cousins.

ISOs make it possible for any gain from the strike price, to exercise price, to the final sale price to be eligible for preferential long-term capital gains treatment. To achieve this preferential tax treatment, however, you might be subjected to alternative minimum tax and must meet various holding requirements.

Non-qualified stock options are much simpler. There is no alternative minimum tax, and no holding period requirements. The gain from the strike price to the exercise price is taxed as ordinary income, and flows directly through to your W2.

What Happens When You Exercise

If you have stock options that have value, that means the prevailing market price is above the strike price of the option. In this case, you’d likely exercise.

The decision to exercise your option can be for many reasons,

- You need the money for retirement

- You are forced to exercise, otherwise the stock option will expire

- You feel as though the stock is at a good price and you want to sell

- You have too much in one company stock and want to diversify

- You have a big expense that you need to pay for

When you exercise your employee stock options, you will be subject to income tax. The amount of tax you pay and the type of tax depends on the type of options you own, but generally speaking you will be taxed on the difference between the strike price of the stock and the exercise price of the stock, multiplied by the number of shares you exercise. The calculation of this figure is known as the bargain element.

To actually exercise the stock options, there will likely be a formal process by which you notify your employer of your intention to exercise the shares, and they help you facilitate the process through a broker of the stock.

The decision to exercise your stock options is often one of particular importance and particular complexity because of the pending impact on your taxes, investments opportunities, and financial planning.

Tax matters because you may need to come up with cash to pay the pending tax bill, or strategize how to cover the tax bill via a cashless exercise. You may also want to strategize how to best minimize, defer, and/or delay the potential tax impact. Investments matter because you should consider your investment risk tolerance, your risk capacity, and the overall concentration of company stock on your investment portfolio.

And financial planning matters because you want to be sure the decisions you make regarding your stock options help you reach the goals and objectives of your financial plan.

For example, it’s important to note that exercising your stock options means that you buy shares of company stock. You take “paper value” and turn it into “actual value” of stock.

By owning stock, you are now subject to the ups and downs of stock market volatility. A good financial plan will consider whether you want to retain the stock, or sell the stock and do something else with the proceeds.

You Could Make a Lot of Money with Stock Options (But There’s No Guarantee)

Think of a start-up company that gives you 100,000 company stock options with a strike price of $1 per share. At issue, they probably won’t be worth much. Imagine though, that the price of the stock goes from $1 per share to $100 per share.

If that happened, the value of the stock options would go from nothing to $9,900,000. This isn’t a common situation, but it’s certainly a possible outcome.

One of the great features of employee stock options is unlimited upside. If your company stock price continues to appreciate, so will the value of your stock options. But you should balance this upside with the other outcome, or the fact that the stock price can go down.

Say you have company stock options worth several millions of dollars, and you’re nearing retirement. Now imagine that your company reports bad earnings, or a new competitor comes on the market and steals all your clients, or the overall economy is down and with that comes your stock price.

These types of bad scenarios may drive your stock price so far down that it wipes out some or all of your value.

This conversation can be summed up with one conclusion: Be realistic in your thinking about the potential value of the company’s future stock price. While it’s common to have a lot of faith in the company you work for, it may be better to take some of your chips off the table rather than being all in, all the time.

You’ve Got Options: Now What?

Now that you have an understanding of the basics of stock options, you can begin to learn more beyond the fundamentals by reading other, more specific or advanced posts on my blog (or more blogs and books like it).

You could manage to plan for your financial future on your own if you want to take the DIY route — but know that there is a lot to learn and a lot of decisions you need to get absolutely right.

If you find that the complexity of stock options warrants a second opinion and/or professional input, you can feel free to reach out to me directly. For many, the resources of a professional may help them produce an ideal outcome that helps them manage tax, invest wisely, and reach financial goals and objectives.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

Your guidance is actually helpful, thanks for sharing this information with us.