Whether due to a planned retirement after a long career, a new opportunity at another company, or an intentional sabbatical from the workforce, there are plenty of good reasons why you won’t be at your company forever.

There are also less-desirable circumstances under which you might leave. While no one hopes or plans to be let go, fired, or forced to stop working for a negative reason, these things do happen.

Either way, for better or worse, it’s important to know what happens to your employee stock options upon terminating your relationship with your employer.

The answer to what happens can get complicated. Depending on why your employment status changes from employee to a former employee and what type(s) of employee stock option(s) you have, the rules surrounding what you can and can’t do with your equity compensation will vary.

The best strategy is to check your plan document for the specific rules regarding your plan. But in the meantime, here is a primer of things to know now.

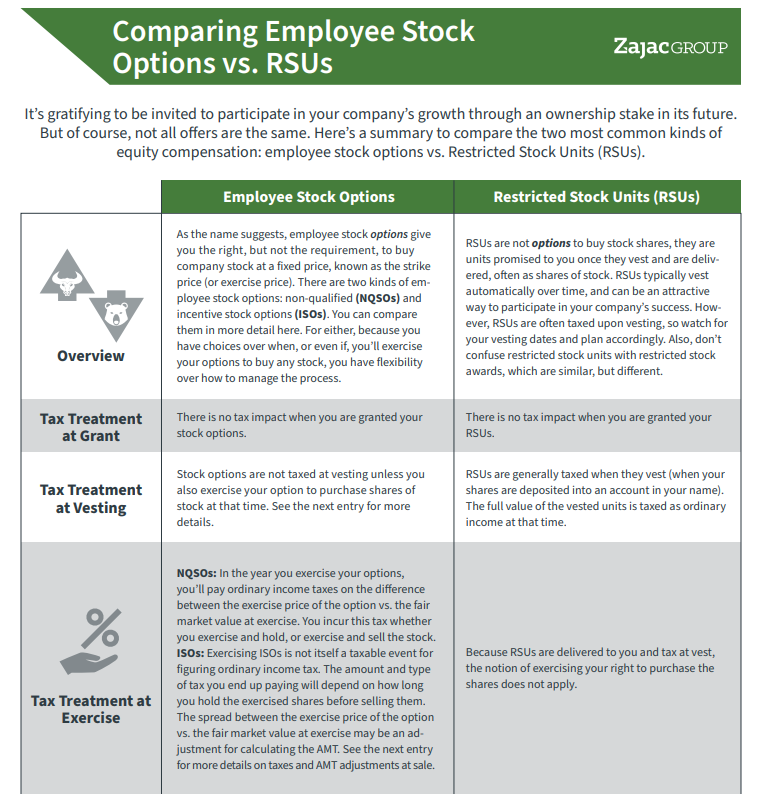

COMPARISON GUIDE

Not All Stock Offers are the Same! Here's a helpful comparison between two of the most common employee stock options.

The Basics of Employee Stock Options When You Terminate Your Employment

Employee stock options are issued with an expiration date. The expiration date is important because it lets you know the last day you can capture the value of employee stock options via an exercise.

The expiration date is often ten years from the grant date. However, every plan is subject to its own rules; again, you should check your plan document to determine specific details like this.

If you do not exercise your employee stock option by the expiration date, your option will terminate, and you will lose the ability to exercise. Subsequently, you forfeit any embedded value. This unfortunate event could occur even if you’re employed with the company.

Your right to exercise your employee stock options may change, however, as your employment status changes. Generally speaking, if you are terminating your employment from your company, you will need to exercise your employee stock options the earlier of the stated expiration date or the new expiration period set in the plan document for a terminated employee.

Change in employment status can be segmented into several categories:

- Termination by choice

- Termination by disability

- Termination by death

Your plan document should help you determine what your post-termination expiration provisions are once you know the circumstances around your departure.

Vesting of Employee Stock Options May Cease When You Leave Your Company

Prior to getting into your post-termination exercise periods, you should know that when you leave the company for any reason, unvested options remain unvested in many cases.

Practically speaking, this means that the in-the-money value of unvested employee stock options is forfeited. The negative impact to your net-worth statement of forfeiting potentially valuable unvested options may be material if you are considering termination of employment.

To illustrate the potential loss of value, let’s assume that you have the following employee stock options:

| Grant | Options | Vested | Exercise Price | FMV | Total Value | Vested Value |

| 1 | 10,000 | 10,000 | $1.00 | $25.00 | $240,000 | $240,000 |

| 2 | 15,000 | 15,000 | $2.00 | $25.00 | $345,000 | $345,000 |

| 3 | 10,000 | 0 | $3.00 | $25.00 | $220,000 | $0.00 |

| Totals | 35,000 | 25,000 | $805,000 | $585,000 |

In this scenario, you have a total employee stock option value of $805,000 if we consider vested and unvested stock options.

However, only 25,000 of the 35,000 options are vested, meaning your current exercisable value is $585,000. That’s considerably lower than the total value of $805,000.

In order to obtain the full value, you have to stay employed with the company until the 10,000 options in Grant 3 vest. Assuming you do work until Grant 3 vests, you will have access to those shares as well. But if you terminate your employment prior to Grant 3 vesting, the value of Grant 3 goes away.

The decision to leave your employer when you know that it means forfeiting unvested options may be critically important in the financial planning process.

If I had a client who wanted to leave because they wanted to retire, for example, we might model out retirement income projections. As part of the projection, we need to know whether to include the $805,000 of total stock option value — or $585,000 of stock option value that could actually be realized and not forfeited before some of the shares vest.

That’s a $220,000 difference, which can make a big impact on how much you can spend in retirement.

If we assume a 3-5% withdrawal rate in retirement, it’s reasonable to assume that retirement, with only vested shares in this example, may be between $6,600 and $11,000 less per year than what this client could spend in retirement per year if all the shares vested.

The timeline until your unvested shares vest is also important. If we assume that Grant 3 is scheduled to vest in the near term, it may make sense to work a little longer, allowing the shares to vest and you to capture the value.

Alternatively, if the shares do not vest for several years, the value of the unvested options is not an important part of your retirement plan, or both, then pulling the trigger to retire and forfeiting the option shares may be a better choice for you.

Exercise Timeline if You Leave to Take Another Job or Retire

If you leave your company voluntarily, either to retire, to take another job, or to take a break from work, you generally have up to 3 months or 90 days from your termination date to exercise your vested options. (As always, check your plan document as this period can be shorter or longer.)

Even if the expiration date of your employee stock options is further out in time than the 90-day exercise window, you must exercise within this new post-termination period.

However, if your original expiration date is after you terminate your employment but prior to the end of the 90-day post-termination exercise window, you will need to exercise by that original expiration date to capture the value.

If you have incentive stock options, your post-termination exercise considerations may become even more complicated. For an incentive stock option to retain its status as such, you must exercise the option within 90 days of termination of your company. This probably won’t be a problem if the 90-day period coincides with the requirement of the plan document.

But if your company gives you one year from termination to exercise your incentive stock options, you will need to exercise them within the 90-day post-termination period even though you have up to one year per the plan document in order to retain their status as incentive stock options.

Both an approaching expiration date and a change of employment status signify a point where you need to make decisions around your options—choosing not to exercise means that you run the risk of losing the ability to capture in the money stock option value.

What Happens If You Become Disabled (or Worse, Die)?

Generally speaking, the timeline you have to exercise your employee stock options may be longer if you become disabled than it is if you terminate for another reason. It is possible that you may have one year from the date you terminate employment to exercise your employee stock options.

If you have incentive stock options and become disabled, the 3-month post-termination exercise period may be extended to 12 months. This allows for additional time to strategize the best way to exercise your options and plan for the future.

Like the post-termination period if you become disabled, the post-termination exercise period for employee stock options, if you die, might be longer than if you leave for another reason. Commonly, one year is used. But as always, you want to check your plan document to determine if your period is shorter or longer.

Many plans will allow you to name a beneficiary of your employee stock options. This person may be able to act on your stock options upon death. They will have the right to exercise the options, sell the options, and/or received the stock shares themselves.

In lieu of a beneficiary, your personal representative in charge of handling your estate affairs will likely be able to assist in the exercise of the shares.

Before You Leave Your Company, Understand What Might Happen with Your Stock Options

When you leave your company, you likely have a short-term period during which you can exercise your remaining stock options. During this time, it’s a now-or-never proposition.

Exercise and capture the proceeds, or let them expire and lose what you have.

With that said, some advanced planning may be available to you. The first step is to check the document to know what timeframes you are dealing with. Know how long you have to exercise and how different circumstances for leaving might impact that timeline.

Next, plan and strategize for your incentive stock options. You might want to consider exercising within the 90-day period in order to retain the ISO status.

And finally, consider how your available exercise periods “wrap” around one calendar year or two. For example, if your 90-day exercise window is between November 1 of one year and January 31 of the next, you may be able to spread income over two years, which is helpful for tax purposes.

A good strategy will know the allowable timeframes and plan accordingly. This planning may include executing an early exercise of some (or all) of your options in an effort to avoid a significant singular tax bill due to a change of jobs.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

Interesting article

I am retiring in a few months. I have non-qualified stock options that have all vested. I will only have 30 days to exercise these options. Is there some way to defer some of the ordinary income tax on this transaction so taxes aren’t all due in the same year?

Hi Craig – Congrats on the retirement.

Generally speaking, you will likely be taxed on the income when you exercise your options. Depending on several factors, you may be able to exercise over one or two (or more) calendar years, which may spread some of the tax bill.

It’s also possible to combine the exercise with other tax deferral strategies, i.e. an increased 401k contribution or participation in a non qualified deferred comp plan.

None of this is a specific recommendation. Just some thoughts. The best solution is likely doing a detailed analysis of your personal situation prior to making any decisions.

Hi,

This post is very helpful especially the sample table above.

The point where I get confused is that I don’t understand what excercising options looks like – I will be forced to exercise my vested options (unless I want to forfeit them) but assuming I want to exercise my options, I don’t understand if this involves me paying tens of thousands or being paid tens of thousands. If it involves me paying my former employer, then why is this considered a form of compensation to me? Seems like I would be compensating them?!

Many thanks for your help, I am going in circles trying to find the answer.

Do companies have any legal obligation to notify you of an upcoming exercise deadline (expiration) within a certain amount of time? For example, if a company notified you that the exercise deadline was non one day, is that legal?

If I vest my stock grant on 6/1 and resign on 6/2 am I at risk of losing my vested stock?

Hi Amy

I would defer to your specific grant agreement for the details. But generally speaking, if you vest on a date that you are employed, and then terminate employment, you should have rights to that grant.

If the grant is RSUs (with a time-based vesting schedule) and shares are delivered, you will often see those shares in a brokerage account.

If the grant is stock options, you’ll want to check your post-termination exercise window to see what your post-termination exercise window may be. One common guideline is 90 days.

There is potential for nuance in specific grants, so again, you should check with your documents and your team of advisors

If terminated by employer

do I lose stock options awarded in annual bonus package but not vested yet?

I did not want to leave but was terminated without cause

Yes, it is very possible that if terminated, you will lose all unvested options/units, even if this is without cause. You’ll want to check your plan docs.

Also, you may have limited time to exercise vested but unexercised options. A common post-termination exercise window is 90 days.

All of my stock options are vested but my company has not yet gone public. What happens if I leave voluntarily to take another job?

You’ll want to check your plan document to see what the rules are pertaining to post-termination exercise.

My company paid out my stock options to me via check. I am not sure what to do with the check. Does it even matter? Assume this will be counted as income and I will be taxed. Wondering if it is taxed at typical rate, or is it at a higher rate such as a bonus. Any information is much appreciated.

Hi

I wouldn’t be able to know without a bit more information. But if you had stock options that were paid out as cash, its very possible this is a taxable event. You might want to consult with a professional for specific help